When sending money from Mexico to the United States, there are two main options. One is a traditional bank transfer, while the other is an electronic payment. The choice depends on your needs. If you want the fastest possible service, you will likely choose the electronic option. This is because an electronic service can send funds directly to your recipient’s bank account. You will need to provide your receiver’s bank account number and the routing code of the involved bank.

For a speedy transaction, you can choose to pay for your transfer with a debit card or credit card. If you use a debit card, you can receive your funds within a few days. Credit cards take a few days, however.

If you need to send money to someone in a rural area of Mexico, you may need a cash-based option. Western Union is one provider that can help you with this. They have an extensive network of cash pickup locations in the US and Mexico. However, you will need to pay a fee if you select this option.

MoneyGram is another option. It is an online money transfer provider that allows you to send money to your loved ones in the U.S., Mexico, and other countries. The company has an impressive network of more than 35,000 locations. As an added bonus, you can track your money’s arrival using the company’s website. Moreover, you can receive a notification if your money has arrived.

Remitly is a similar online money transfer service. Their website offers low fees, and you can get your money delivered to your recipient in just three to five business days. In addition, you can also use their mobile app to make a payment. A great advantage of using Remitly is their customer service, which is available in both English and Spanish.

Xoom is another option for people looking to send money from Mexico to the US. This service has a network of more than 35,000 locations in the United States. Using this service is simple. Once you have completed your online or phone application, you can pick up your cash. Xoom can also reload phones for your loved ones in Mexico.

Instarem is a money transfer service that provides same-day transfers. It is a little more expensive than some of its competitors, but it is the fastest and most reliable option. While a nominative check cannot be sent to the US, you can get your money in a timely manner with this service.

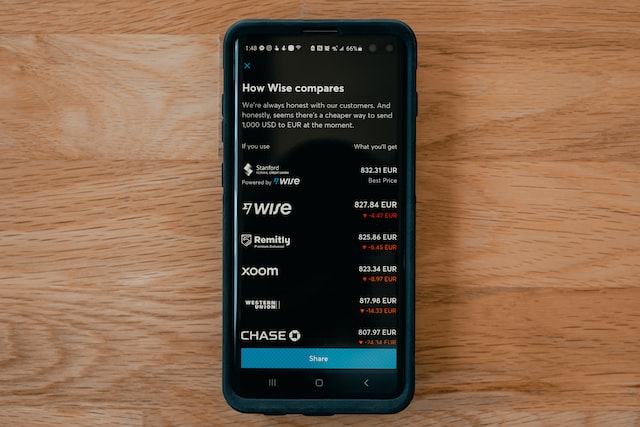

Wise is the fastest money transfer provider to the United States. Despite the name, it is actually based in Mexico. This is a reputable service that offers a high quality product and competitive exchange rates. There is a $3.99 minimum charge for your first transfer and an additional 3% fee if you opt for credit or debit card payments.

When choosing an international money transfer provider, it is important to compare the various options. Some of the companies offer discounts or coupons to save you money. Choosing the right provider can be a daunting task. That’s why it’s helpful to choose a provider that matches your needs and preferences.

Photo by Tech Daily on Unsplash